In every significant event that arises, there are financial losses generated, but wealth is also created. During the COVID-19 pandemic, many people lost their homes, savings, businesses, and jobs in financial matters. In contrast, retail companies like Amazon, Walmart, and internet-based companies grew and generated significant profits due to their online presence. The companies that attempted to do the same had to start from scratch and did not achieve much profit. Currently, one of the most significant events happening in the world is the conflict between Israel and Hamas, which has raised global concerns. It is expected that a peace agreement will be reached. However, from a financial perspective, you should know how to capitalize on the companies affected by this event to gain profits.

Geopolitical events can have indirect effects on businesses, especially those headquartered in affected regions. Factors that can impact a company during these events include disruptions in the local economy, supply chain interruptions, changes in investor sentiment, and alterations in government policies. Companies can also be affected by the overall state of the economy and investor sentiment in the aftermath of such events.

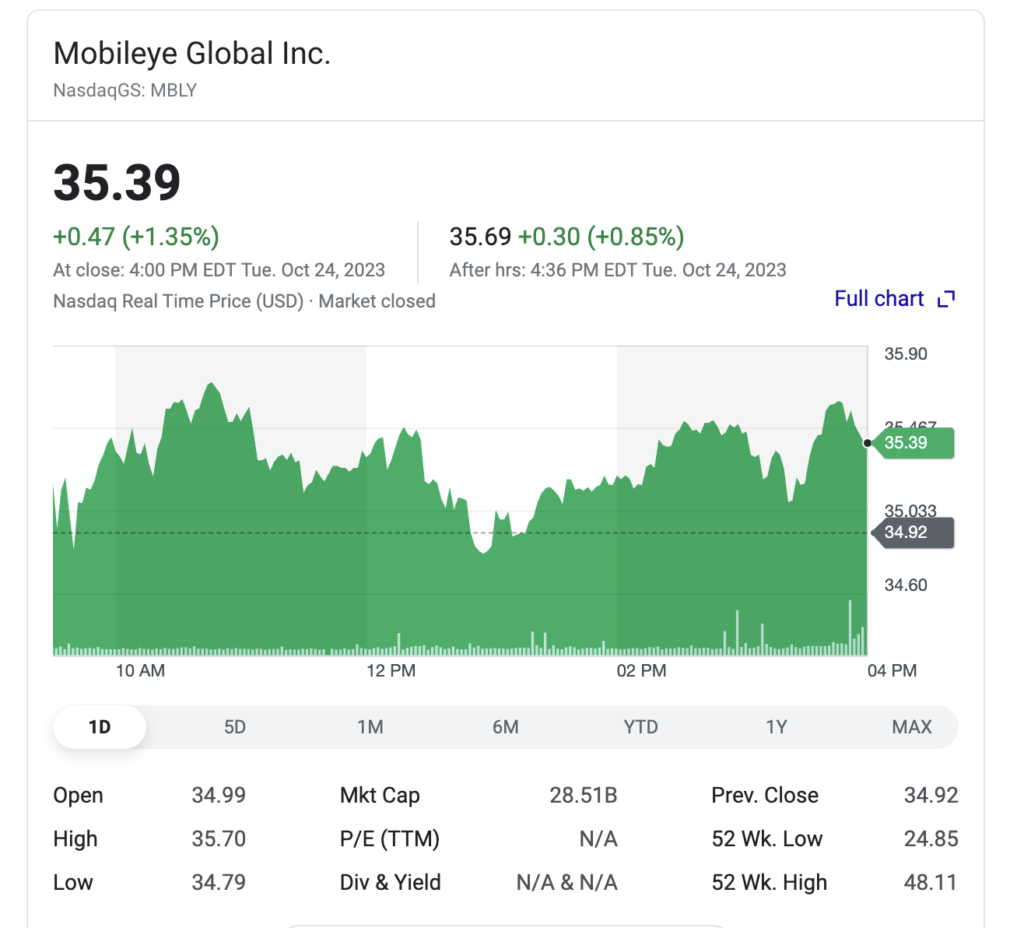

Mobileye, with the stock symbol MBLY, is a prominent company in the field of Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies. It is located in Jerusalem and is directly affected by the current conflict. The company does not pay dividends and will release its financial results for the third quarter of 2023 on Thursday, October 26, 2023.

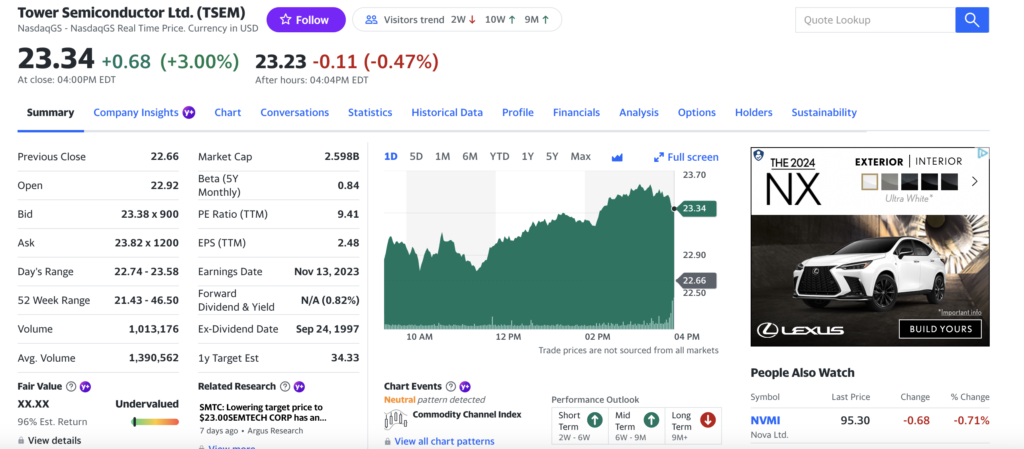

Tower Semiconductor, with the stock symbol TSEM, is believed to be significantly undervalued according to some analysts. The company’s financial condition is strong, and its profitability is fair. The shares have lost about 40% of their value in the past year.

These are the two companies I am currently analyzing to see how they perform during this significant global event.

Bitcoin (BTC) has experienced an increase this week due to growing optimism about the potential approval of multiple Bitcoin exchange-traded funds (ETFs), as stated in a research report by JPMorgan (JPM) published on Wednesday. The momentum in Bitcoin appears to be partly driven by the ongoing optimism surrounding a potential Bitcoin ETF.