I want to share with you the information I’ve gathered over 7 years of investing in the United States stock market. When I arrived in this country, my primary goal was to find a way to make money while I slept, and one of the avenues that intrigued me was investing in the stock market. However, before venturing into it, I realized the importance of educating myself properly, especially after hearing discouraging stories about people who lost their savings and even their pensions.

The stock market is a tempting opportunity to accumulate wealth, but its volatility and risk cannot be ignored. For this reason, I want to emphasize the importance of learning to manage risk before getting into any trade.

Throughout this article, I’ll share the tools that have helped me make money, but I’ll also talk about the mistakes I made in my early days. Despite my experience, I want to stress that the financial world is a constant process of learning. Making mistakes is natural, but what’s crucial is learning from them and evolving as an investor.

1.Ongoing Education

In the era of online information, you have access to books, podcasts, and YouTube channels that will provide you with valuable knowledge. It’s essential to find experts aligned with your investment style, though remember that every investor has their unique approach. Create your own style as you progress.

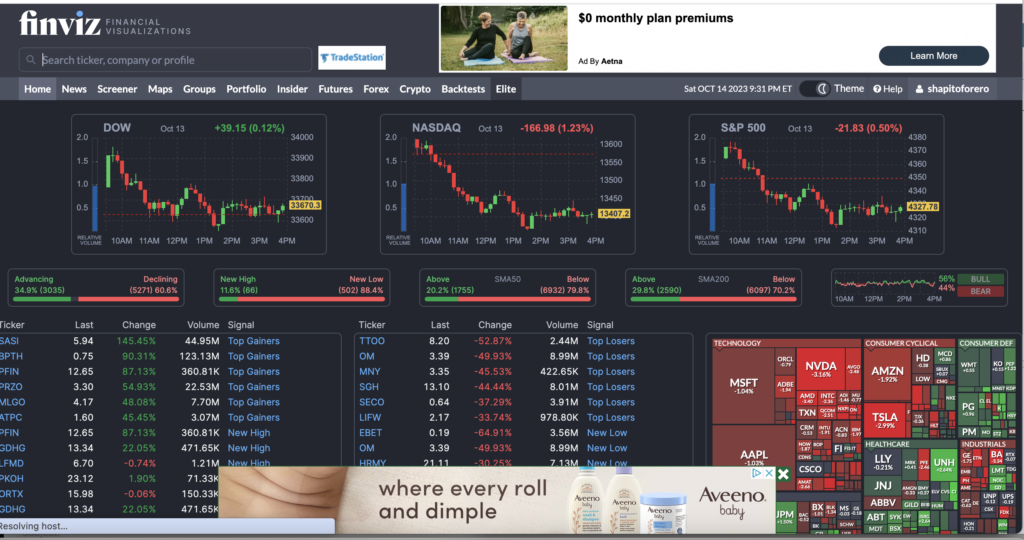

2.Finviz

This tool offers valuable information about any company, whether you’re operating with technical or fundamental analysis. You can access signals, recent news, and tracking of trades made in the company, helping you select companies that fit your strategy. In my opinion, it’s one of the best free screeners on the market.

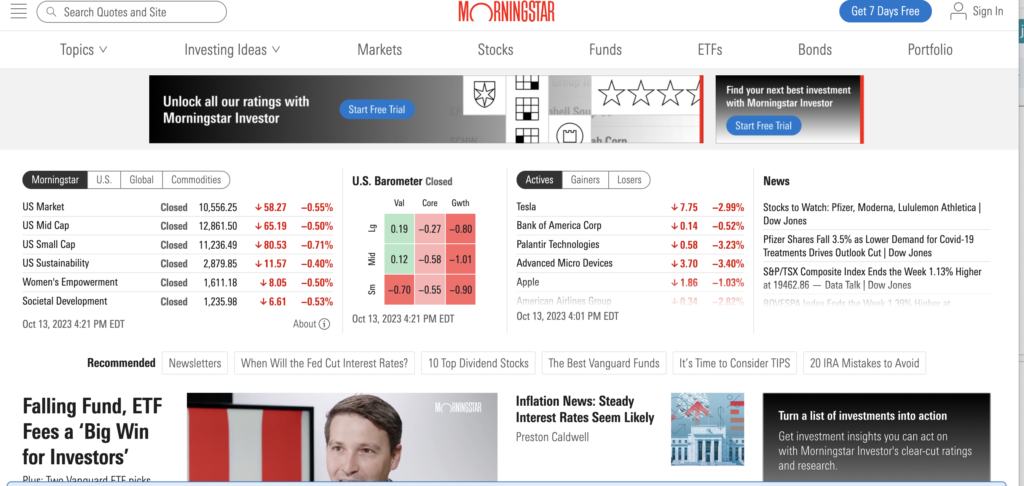

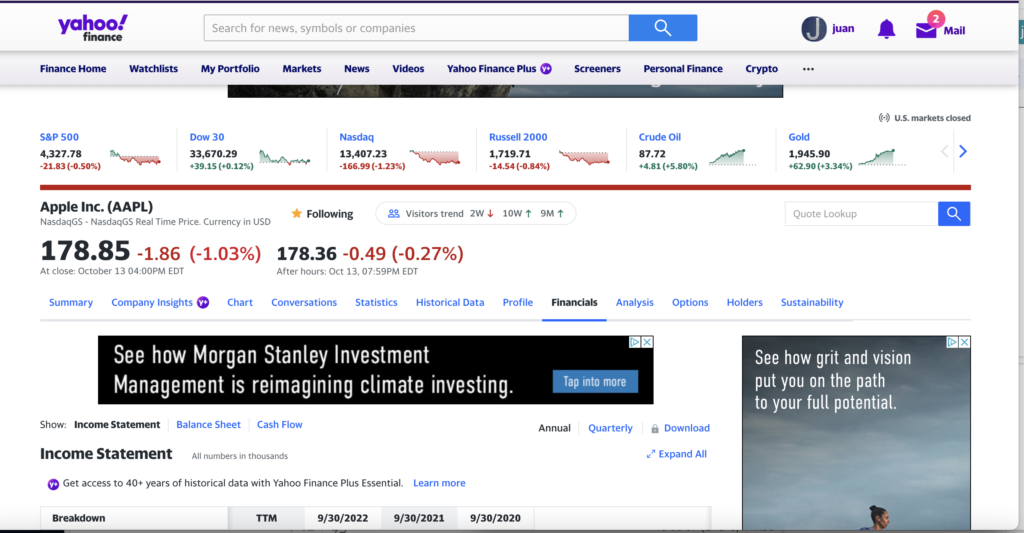

3.Morningstar or Yahoo Finance

These platforms are useful for analyzing income statements, balance sheets, and cash flows of companies. Compare this data with the latest quarters and years to assess growth and financial management. Also, compare companies in the same sector to make informed decisions.

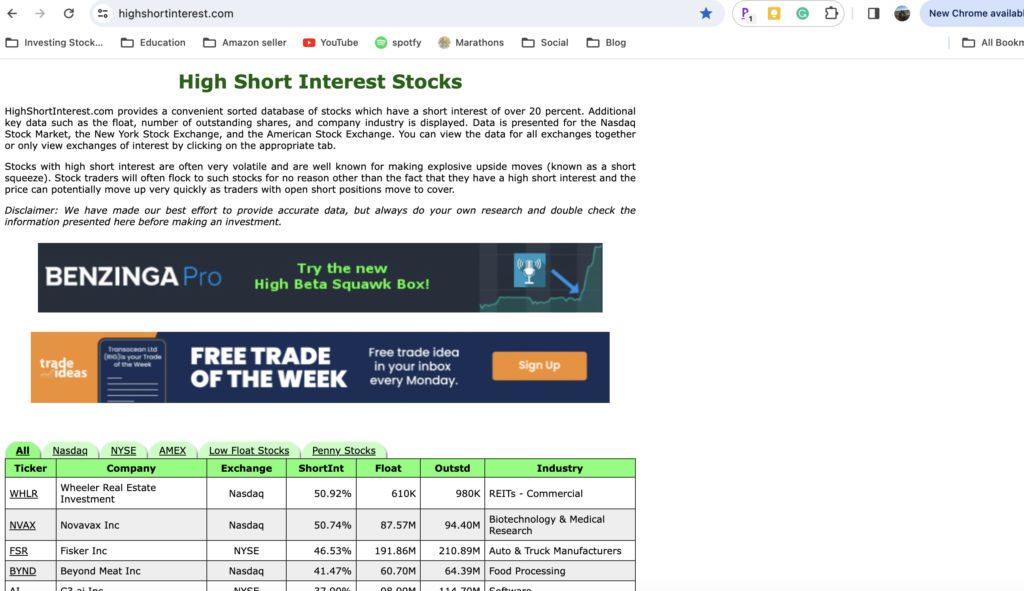

3.Short Selling

It’s useful to check whether mutual funds are shorting the company you want to invest in. This will give you an idea of potential counterparts and risks before investing in a stock. Remember that it’s about making the best possible decisions to generate income.

4.TradingView

Use this tool to find entry points based on technical analysis. I recommend using “Volume Profile” to identify support and resistance levels. Study charts at different scales, from monthly to daily, to identify strong levels. The wider the price range, the more validity these levels have.’ Use this tool to find entry points based on technical analysis. I recommend using “Volume Profile” to identify support and resistance levels. Study charts at different scales, from monthly to daily, to identify strong levels. The wider the price range, the more validity these levels have.

Great blog and valuable information. Thank you juan