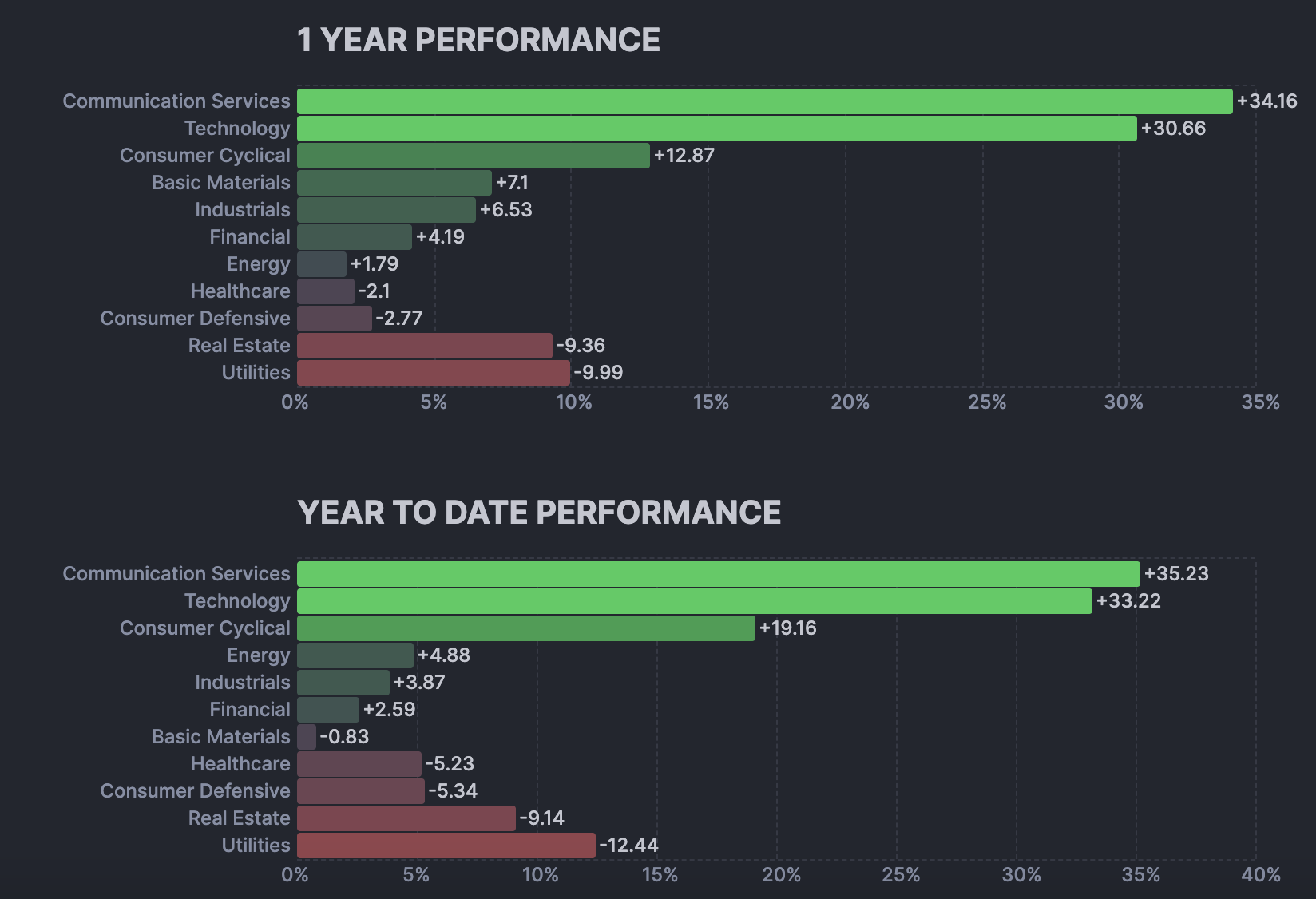

When analyzing the performance in the year 2023 so far, it is evident that the communication services sector has excelled with an impressive performance of +34.16%. In second place, the technology sector has achieved a solid +30.66% performance, closely followed by the consumer cyclical sector with +12.87%. The difference between the second and third sectors is noticeable. Finally, the utilities and real estate sectors have lagged behind.

In the case of the real estate sector, its performance has been moderate due to the slowdown in the acquisition of both residential and commercial properties, exacerbated by increasing interest rates. This has made it challenging for people to acquire new properties. Meanwhile, the utilities sector has experienced the worst performance, despite traditionally being attractive to investors due to government support and stable returns. However, this year, investors have chosen to invest in other sectors, leading to a decline in the utilities sector.

Regarding the communications sector:

“The communications sector has shone in the first part of 2023, driven by the growing demand for services such as internet access, content streaming, and cloud services. This trend is expected to continue as more people rely on digital communication and remote work or education. Competition within this sector encourages innovation, with companies constantly seeking ways to differentiate themselves and offer new and improved services to attract and retain customers.

A notable example is Google, which invested in the startup Anthropic earlier this year and recently agreed to an additional investment of up to $2 billion, as reported by The Wall Street Journal last week. This commitment followed a previous agreement by the startup to allocate over $3 billion to Google Cloud. Moreover, other companies like Microsoft have made significant investments in OpenAI. Meanwhile, OpenAI is also spending a substantial amount on Microsoft’s cloud infrastructure.

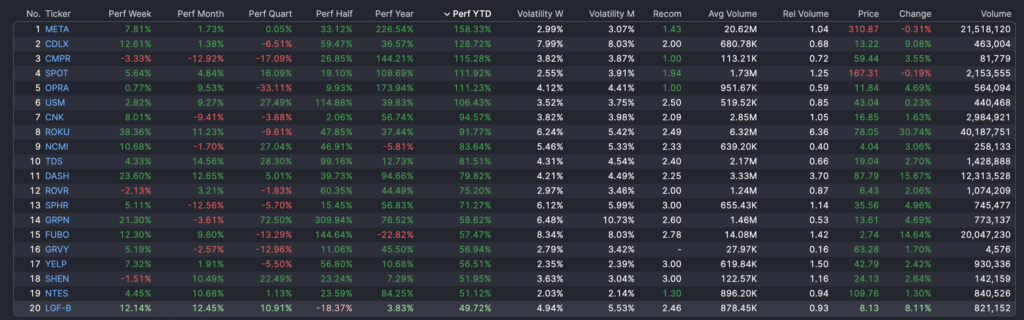

It’s worth mentioning that Meta has experienced tremendous growth of over +170% in the first part of this year. Meta collects massive amounts of data from its users and leverages this information for targeted advertising, content recommendations, and other monetization strategies. This data-driven approach is contributing to a significant increase in revenue this year.