When it comes to effectively managing our finances, there is no more powerful tool than a well-planned budget. A budget provides us with a clear and detailed view of our income and expenses, enabling us to make informed decisions about how to allocate our resources. In this blog, we will explore the importance of budgets, how to create them, and practical tips to stay on the right financial track.

What is a budget and why should it matter to you?

A budget is a financial plan that sets your goals and limits your spending based on your income. Imagine that your money is a limited and valuable resource—because it is! A budget helps you give purpose to every dollar you earn. It aids in avoiding impulsive spending and ensures you’re saving enough for your short and long-term goals.

Steps to create an effective budget:

- Calculate your income: List all sources of income, such as your salary, additional earnings, or investments. This will give you a clear idea of how much money you have available.

- Record your expenses: Keep a detailed track of all your expenses for a month. Divide expenses into categories like housing, food, transportation, entertainment, etc. This will help you identify where you’re spending more and where adjustments can be made.

- Note your debts: It’s important to know how many debts you have, the payments, and the interest rates on them. This helps prioritize which debts to pay off first, ensuring a significant portion of your income isn’t going towards interest. I recommend paying off all debts while focusing on the smallest debt to leverage the snowball effect. Once the smallest debt is cleared, allocate that money to the next smallest, and so on.

- Set your goals: Define your financial goals, whether it’s saving for a trip, paying off debts, buying a house, or any other objective. Assign specific amounts to each goal. Nowadays, banks offer features like automatic transfers to savings accounts—extremely useful for directing money towards our goals. Having a larger objective and creating milestones to achieve it is beneficial.

- Record all your accounts: List your savings, checking, investment, and retirement accounts to understand your overall financial situation.

- Adjust and review: Review your budget weekly over the weekends and make adjustments as needed. Flexibility is key, as life is full of surprises.

Tips for maintaining a successful budget:

- Record every expense: Note down all expenses, even the small ones. This provides an accurate insight into your spending habits and areas for improvement.

- Be realistic: Avoid setting overly extreme savings or spending reduction goals. It’s important for your budget to be achievable and sustainable. The goal is to create a healthy financial lifestyle.

- Use technological tools: Many budgeting apps and software are available to simplify tracking and managing your finances.

- Reward yourself: Celebrate your financial achievements, big or small. This will motivate you to stay on the right path. Remember, life requires a balance—some of your income should be enjoyed while another part works for you.

- Don’t give up: If you exceed your budget in a month, don’t get discouraged. Learn from your mistakes and move forward.

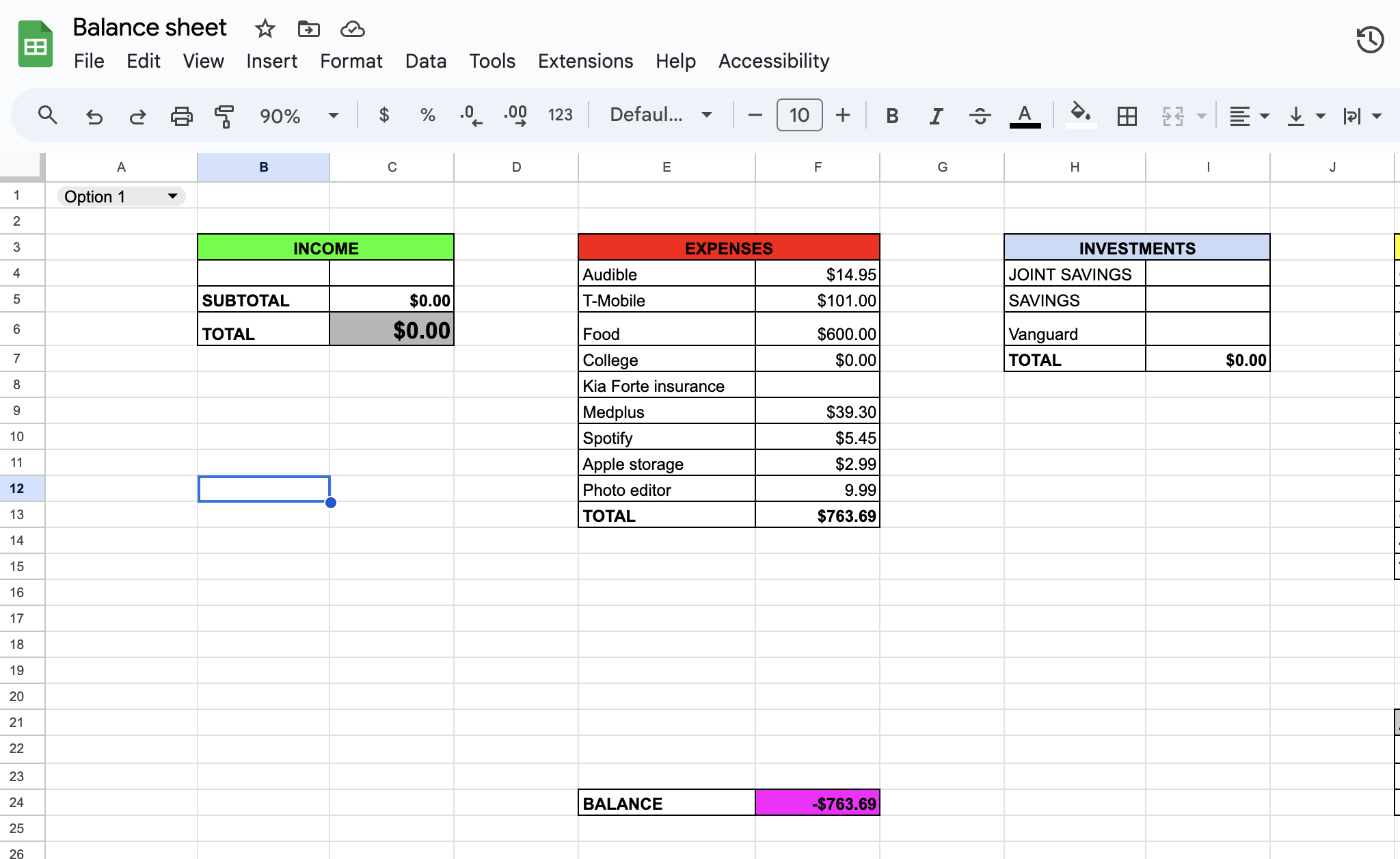

We will delve into these topics in detail and provide practical tips for a successful financial life. I’ll also give you an example of my spreadsheet that I’ve used for over 6 years to track my budget. Keeping it simple is key to maintaining it. Stay tuned for our upcoming posts!